Sustainability Specialist: Doug Johnson

Sustainability Specialist: Doug Johnson

Sustainability specialist, Doug Johnson, is Founder of Mesh Energy – a smart renewable energy consultancy firm. He is the first 'Meshling', a chartered mechanical engineer, author and has over a decade of experience in the sustainable design and delivery of low energy buildings. Doug is also the author of ‘Right First Time’: An Architect’s Practical Guide to Planning and Delivering Low-Energy Projects.

1. What was your background prior to starting Mesh Energy?

I studied as a mechanical engineer and did a bachelors and then Masters degree at Brunel Uni in London. After having worked at a large engineering company in Havant and in parallel started a ground works contracting company on the weekends, I realized after a few years that engineering wasn’t for me. My dad had taken early retirement and he mentioned that an old colleague of his had set up a new renewable energy installation company in Norfolk. We did that together for five years and grew it to a turnover of £300K to £10M in that time. After that I did a very short stint project managing large scale solar PV farms around the UK and after having had enough of that I realized it was time to do something for me that I loved in the domestic built environment sector. Mesh was born!

2. Where did the inspiration for starting Mesh Energy come from, and what sets you apart from your competitors?

As I mentioned, I worked for a company installing renewable energy equipment back in 2008. We were selling what was profitable and what we knew. Frankly a lot of early adopter architects and clients got heavily stung and disappointed due to poor advice that wasn’t in their best interest. I set up Mesh to be holistic and independent and to help clients and design professionals to make their sustainable projects as successful as possible. Increasingly we use analytical software blended with services design (MEP) to great effect on all kinds of projects.

I know we have a massive USP besides a blended analytics and MEP offering, which is getting in early in the building design stages, before planning and helping the design team and client all the way through developed design, detailed design, construction, handover and post occupancy analysis. No other company does that, I know and the value of projects over this term is huge.

3. How did you initially obtain finance for your company?

I set aside £10k of my own money to make the business work at the start and have bootstrapped the business all the way from there. The only exception was in Jan 2020 I borrowed money for growth. Really, that was ridiculously lucky as that kept the lights on for six months as Covid hit, until our sales recovered.

4. Have you encountered any significant obstacles in your career to date? If so, how have you dealt with them?

I have officially lost count, but the “top 3” include poor management of me by managers forcing my hand in entrepreneurship and not doing enough due diligence before choosing a business partner.

The first one is easy, after continued poor management in other companies I decided I had nothing to lose. I figured a monthly salary was not worth the stress and eventually I figured that I really had no control over my destiny working for others. So, I set up my own company with what I knew! Best thing I ever did.

As for the second obstacle around partners…quite quickly after setting up Mesh I decided I ‘needed’ a business partner. I was too naive and got a partner who was easy to get on with, locally based and in the renewables industry already. He turned out be a nice guy but had no reason to work hard and he turned out to be a dead weight. It took me over two years to realise and once I dropped him the business really took off.

5. What three characteristics would you say a successful entrepreneur must have?

Absolutely the first is resilience and self-belief in what you are trying to do. Everyday is a total rollercoaster and you have to keep getting up, having had some small or large setbacks knowing that the end goal is worth it, and you will get there. Any weakness in this vision will lead to excuses, fatigue and your business failing. A great business idea can easily be trounced by lack of resilience and self-belief by the founder and likewise a mediocre idea can thrive. Persist!

I reckon the second key characteristic is the ability to start from a position of trust and build that into your team. Everyone gets the chance to prove they are not trustworthy, but starting from a position of trust is, sadly, very refreshing for most teams and they will often prove your more right than you ever thought possible. When times get tough this is key and the team will trust you!

Finally, I reckon a successful and well-balanced entrepreneur needs a distraction. Passion for your business can be all consuming and quickly turn unhealthy. Entrepreneurs have total freedom to do what they want and some kind of hobby or non-business activity you are also passionate about is key to making sure you live to see and enjoy your end goal.

6. Who do you look toward for advice and why?

I have a business coach which I have successfully used for the last five years, but I also try to keep a network of other more experienced and diverse business owners in my rolodex! I also read a lot of books and how you choose to select nuggets of information from all these sources are key to helping me form important decisions, every day.

7. Since founding the company in 2013, how have you grown your client base?

From me and a laptop and Google in 2013 we have grown on average from 2017 with a revenue of £125K (high end domestic homeowners) to this year, seeing a 100% increase in revenue growth, to £1.2M (homeowners, developers, companies and councils). We have mainly done this through education of architects and developers and following the philosophy of ‘give to receive’. It has served us well and will continue to do so well into the future.

8. What key trends do you think will impact the renewable energy consulting industry in 2023?

Net Zero carbon is becoming the new buzz word as well as some strong moves in air source heat pump technology, there is loads of juicy gossip about what large investment is going to do to the sector but let’s see. Centralised building software modelling I think will also start to be appreciated more by the sector to reach increasingly aggressive sustainability targets.

I am hoping our services will be in stronger demand than ever and that more people will realise the benefit of early-stage building performance analysis and continued support.

9. With oil and gas prices skyrocketing, do you think we will see more countries accelerating the transition to cleaner sources of energy?

No doubt. Massive divestment in oil and gas is taking place at an institutional investment level and ESG (Environmental and Sustainable Goals) are now being taken very seriously at the highest levels of business and global commerce. There is more and more data coming out that suggests decarbonization is better for economies around the globe, so smart countries will see this as a huge opportunity to grow in otherwise uncertain times.

10. Congratulations to you and the team for on your recent abseil off Spinnaker Tower! How did you find it?

I love stuff like this. I did a huge amount of rock climbing and abseiling at uni but doing it 20 years on is still really fun. It is great to do it with the team and for such an awesome local charity.

Rapid Fire:

- If you could gain a new skill instantly, what would you choose?The ability to separate time wasters from decent clients, sooner!

- What was your first job? Lawnmowing for neighbours on a ride on tractor at age 10.

- What dish do you cook the best? I bake a mean raisin, banana and cinnamon loaf.

- Are you a morning or evening person? Morning! 5am starts in the summer are simply unbeatable.

- Have you ever lived abroad? Yes, luckily my parents travelled a fair bit with work, so I saw the US for a couple of years as well as Switzerland in later years.

Cybersecurity Expert: Nicholas Powell

Cybersecurity Expert: Nicholas Powell

Cybersecurity expert, Nick is Founder of Erika - an online safety technology that safeguards the digital wellbeing of employees and their families by protecting them from people who mean them harm online (protection from online fraud and child grooming) and by providing user support to internet addiction. Erika is made available as an employee benefit through HR departments as part of an employee digital wellbeing programme.

1. What was your background to setting up Erika?

My personal background is in Risk Management. After graduating from University, I served in the British Army for 7 years before setting up an Information Security consultancy, which I ran for five years serving UK and US businesses. Always wanting to get into the tech sector, I used my time consulting to develop thoughts to online safety & security problems that could be solved with technology. When my consulting conversations were put on pause during COVID, it gave me the push to build the engineering team and start our journey with Erika. There was no better use of time during lockdown to grab a blank sheet of paper and to start innovating.

2. Where did you get the idea for your business and what sets you apart from your competitors within the cybersecurity market?

Our Personal Online Safety & Security is integral to the security of the businesses we work for, our own digital wellbeing and the wellbeing of our family – and yet is an area that I saw as under-served by technology – particularly in combatting the rising threat of online fraud, scams and child grooming done through social engineering; and so it is this problem that we serve. I also recognised that businesses have an interest and role to play in helping their employees and their families stay safe online, to maintain wellbeing, productivity and happiness in the workplace and so Erika is uniquely made available as an employee benefit through HR departments as part of employee wellness programmes.

3. Did you experience any challenges at the beginning of your journey? If so, how did you overcome them?

The start-up journey has daily challenges. Finding a gap, building a product to serve that gap and going to market is by its very nature, hard. One early unforeseen challenge that we faced in product development was a cultural one – we knew that the key to building something that people wanted was to build an MVP, stay lean and speak with the end user to get feedback and iterate. Our first focus was to protect users from online fraud. We hypothesised that our most loyal users would be those who have already fallen victim to fraud – all we needed to do was to find them and talk to them. We quickly learned however that people who were victims of online fraud don’t like talking about it – they are embarrassed and don’t step forward to speak about their experiences. This gave us challenge from an early product perspective and we had to resolve it by using fraud statistics and expertise to build from – who was being scammed the most and how. We’ve since expanded the product offering to support employees with family and child online safety, where users (parents) are much more willing to have a conversation about their thoughts and needs in the topic, giving us a stronger basis for iteration.

It’s also true what they say about the team being the most important part of a start-up and why you read that investors look at team first and foremost and product/market thereafter – they know that your first product idea or hypothesis is likely to be challenged, but with a first-class team you can overcome the unexpected.

4. Do you currently have any other additional business opportunities or ideas that you are passionate about?

We want to be the leaders in online safety & security for employees and their families and we have a product roadmap and strategy to achieve that. This will be our mission for the years ahead.

5. What do you enjoy most about working for yourself?

By its very definition entrepreneurship is all about creating something new, creating your own rules and changing the norm. It’s hard but it gives you fulfilment and satisfaction that cannot be matched.

6. How would your colleagues describe your management style?

Ha, mmmm – well from my Army days I would like to say I lead from the front. In the office the team would likely say I have a fair approach – fairly relaxed but that I micro-manage probably a bit too much! It’s a very hard balance when you are in the early stages of start-up to be the custodian of investors’ money but at the same time wanting to give the team free reign over their department. If you go off course, it’s me who is accountable as CEO but at the same time you want the team to have freedom of action and thought. It’s a tough balance I have yet to master.

7. What strategies did you initially employ to promote your cybersecurity business?

At its core Erika is a consumer product, and so a direct-to-consumer marketing strategy is perhaps an obvious route to market – but D2C it’s expensive and attritional. We instead recognised that businesses were being impacted by the personal online safety & security of their employees and making Erika available as an employee benefit as part of HR wellness programmes, was the quickest and most valuable route to market. Digital wellbeing will increasingly become a critical aspect of employee Personal wellbeing and it’s this growth area that we serve.

8. Do you think there will be many changes within your current sector in the next 10 years, and how do you envision the future for Erika?

In addition to safeguarding the Digital Wellbeing of employees for their personal health and productivity, the personal digital assets of employees and their families are now and will become ever more, a critical component of enterprise security. Here, hackers will increasingly seek to profile and target employees on their personal accounts and online channels, to subvert and penetrate the businesses they work for and is a risk amplified by the work from home environment, that has readily crossed and muddied our personal online workflows with our business workflows. The future of enterprise defence will therefore require Info Sec teams to extend resources towards tools like Erika, that serve the business ‘beyond the gate’ that protect the individual and their families.

9. If you could offer a first-time entrepreneur only one piece of advice, what would it be?

Not to be afraid of failing. You can only learn by failing – so fail fast, learn and iterate. I am very critical of the ‘British way’ that does not readily allow others to try new things for fear of failure or judgement. Testing hypotheses and finding product market fit can ONLY be achieved by failing fast. So, embrace failure, learn, iterate and succeed.

Rapid Fire

- Name a person that inspires you. – Phil Knight. A cliché perhaps but read Shoe Dog and you’ll join the club.

- What’s the best meal you have ever eaten in a restaurant? – An Army ration pack on Sennybridge training area in Wales. Al fresco dining at its best after a hard day at the office.

- Are you more of a morning person or a night owl? – Definitely a morning person. I have two boys under the age of two – I am a morning person.

- What is one thing about you most people don’t know? – That I’m one day going to get my CTO to teach me how to code (don’t tell him – it could break him).

- What is your best childhood memory? – The Indiana Jones ride at Disney World, Florida, aged 9.

The Rise and Rise of Direct Investment

The Rise and Rise of Direct Investment

The boom in private equity has historically been driven by traditional “blind pool” private equity funds. This remains very popular and is a well-trodden path with demonstrable success. However, in recent years, across the international investment landscape we have seen a huge increase in the number of “deal-by-deal” PE managers providing access to direct investments in target companies to their investors.

Some deal-by-deal operators have emerged out of necessity, where they have been unable to raise a traditional blind pool fund. However, others entered the fray to either serve an investor base with an appetite for greater control over their investment decision making (and risk), or indeed to address deals, and/or deal structures, that traditional PE funds cannot fulfil, or deliver on.

Investors are allocating an increasing portion of their private equity commitments to direct investing, backing what, in the US, is referred to as a “fundless sponsor”. Here in the UK, we have seen a number of market entrants successfully provide investors with access to lower-mid-market and mid-market deals on a deal-by-deal basis over the last decade.

Years ago, we identified that certain investors, particularly the more private investors such as family offices, and Ultra-High/High Net Worths, have fluctuating liquidity (which is a factor), and also wanted to have greater control over the investments they choose to get involved in. Deal-by-deal sought to address this, allowing them to pick and choose when to participate to suit their own cashflows and their investment appetite at the time.

However, over the years, what also became clear was that having total flexibility, unencumbered by the traditional PE fund “rules” (set out in the fund investment agreement with LPs) meant being able to be more creative about deals. Its less a case of having to force our square peg into someone else’s round hole – need high yield debt or fixed return preferred equity?… no problem, need minority investment for an eight-year hold period?… no problem – the fact is the investors themselves get to decide what works for them in a given scenario, which makes the deal-by-deal operator more flexible.

This works the same way with sector limitations too. We recently had a business on our desk involved in defence (a sector which for obvious reasons is in a current period of strong growth) – which the PE funds had universally declined based on ESG concerns, and in most cases forbidden by the “rules” of the Fund. Not bound by these same limitations, a deal-by-deal operator can consider a deal like this and leave it to investors to determine whether they wish to participate in it. The end investor can take their own view on the ESG matter, rather than having a blanket approach. This could be the same in a plastics business, a sex toy business, or a CBD products business, all of which have crossed our desk with the same problem for blind pool PE funds.

And certainly, the rise of the direct investment class has brought a whole new generation of investors into the asset class. Where private equity would historically have been the domain of institutions and the super wealthy, some managers have made it possible for investors to participate in deals for a few thousand pounds. This provides access to a whole new cohort of investors, which some would argue is increasingly democratising the asset class. Some deal-by-deal operators have investor databases which run into thousands of names.

Investors have also told us that they like that, as a deal-by-deal manager, we are more aligned with their interests because our economics come from co-investment in sweet equity – we sit in the same instruments as our investors. We don’t need to “trigger carry” in a fund or sell businesses at a sub-optimum moment to provide the exit credentials needed during the fundraise for the next fund. We sit alongside our investors maximising returns for them on a specific asset – and investors seem to like that. Added to which, deal fees are also deal-specific – investors tell us this is preferred rather than the AUM fees of a traditional fund. That said, we do see some deal-by-deal operators charging comparatively high deal fees, but like all things this will have a way of finding its market norm (much like it has for traditional funds).

There are undoubtedly pros and cons for both the model of a traditional fund and the deal-by-deal model, but both are here to stay and the continued growth of the latter may provide new tools and opportunities for vendors, shareholders, management teams and intermediaries on deals, and with that, greater opportunity for a wider and deeper pool of investors. Interesting times indeed!

Further Information

Del Huse is Founder and CEO of deal-by-deal investor Roycian Ltd. www.roycian.com

Bluebox Velocity was created in the depths of ‘Lockdown 2020’ by an exceptional team of world-class developers and techies alongside professionals with more than 100 years of combined experience in mid-market Mergers and Acquisitions. It sits seamlessly alongside Bluebox Capital, founded in 2022.

Bluebox Capital is a leading early-stage investment organisation supporting high-growth, UK-based businesses across all sectors, with cheque sizes of between £50,000-£250,000 of capital as well as guidance and expertise.

The Importance of Financial Modelling

The Importance of Financial Modelling

In this post, we share some advice on the importance of Financial Modelling and highlight 4 key points that you should be aware of.

Know what a financial model is

A financial model is a representation of a company’s operations expressed in numbers and typically comprises the past, present and forecasted future performance of the company.

Financial models are essential decision-making tools that company’s use in a variety of scenarios to help advise business strategy. Financial models assist strategic planning when evaluating projects such as growing a business organically, making acquisitions, raising capital, capital allocation, setting/assessing bank covenants.

Analysts and advisors use financial models to anticipate and consider the impact of certain events on a company’s performance. Both internal and external factors are considered when evaluating these models which in turn advises investment decisions and company valuation parameters. Financial models can be structured in a variety of ways to address scenario planning, investment appraisals and deal specific considerations.

Know your business financials & growth drivers

It is critical to have a strong understanding of your company’s financials, past trends, and underlying growth drivers.

Credibility is a key component of a strong financial model. Whilst a financial model is unlikely to be 100% accurate, it is important to demonstrate credibility by ensuring that assumptions are well thought out and take a considered view of both internal and external factors which influence the business.

Developing a ‘sensible’ set of assumptions around the expected growth drivers associated with the business is important. Ideally a company wants to outperform a set of forecasts as this will add credibility to an opportunity when it is being evaluated externally.

Structuring your financial model

Structuring a model effectively from the outset is important to ensure outputs are consistent, accurate and well considered. A typical financial model will produce a profit and loss, balance sheet and cashflow.

Examples of best practice to follow:

- Create a plan from the outset

- Keep the model’s inputs, calculations & outputs separate

- Ensure data validation and error checks are incorporated

- Avoid links to external sources

- Include explanations where necessary

- Ensure the model can be rolled forward on a monthly basis for trading updates

Look at it from a buyer/investor perspective

It is important to consider what buyers/investors are evaluating when preparing and presenting a financial model. Some key aspects to contemplate include:

- Assumptions: how they have been derived and how credible they are

- Growth profile: how this compares against historic performance and wider macro trends

- Sensitivity analysis: “a what if” analysis assessing the impact that various scenarios have on the financial model and expected outcomes

- Cash generation: that there is sufficient cash generation to support all of the cashflow requirements of the business along with delivering investor expectations

- Financial statement analysis / ratio analysis: use financial and accounting ratio analysis to evaluate the financial performance of the business, comparing this with historical ratios and similar businesses in the industry

Further information

Whether you are looking to understand your overall exposure to risk, investment funding requirement, or future-planning, Velocity can provide you with the financial modelling support you need. Take advantage of our years of experience and speak to one of our expert modellers now.

Click here to watch a recording of our recent webinar on The Importance of Financial Modelling

Staff Interview: Oscar Draycott, Research Analyst

Staff Interview: Oscar Draycott, Research Analyst

What was your background prior to joining Bluebox Velocity as a Research Analyst?

I had recently graduated from Exeter University with a Masters in Mechanical Engineering. In November 2021, I went on to complete 2-weeks at an Investment Bank called KBW where I proofread sell-side decks and attended multiple strategy meetings involving directors and analysts. I began working for Bluebox Velocity in December 2021.

What were your motivations behind choosing a career in Corporate Finance?

Although it deviates from the usual path coming from an Engineering background, I learnt early on that the work shares a lot of the same characteristics. The industry seemed to fit my strengths well. I liked the constant harmonisation between the technical analytical skills alongside the softer more personable skills.

What is the best advice you have ever received?

Listen more than you speak.

What does a typical day look like for you at Velocity and what are you currently working on?

On a typical day, I spend most of my time constructing sell-side pitch decks and accumulating potential acquirers for our clients. Both these tasks tend to require the extrapolation of key market trends and the ability to paint a picture of the client’s landscape to investors or acquirers.

What do you find most exciting about working as a Research Analyst for Velocity?

The best part about my role is the access you get to a broad variety of sectors. I also get to partake in calls with experienced management teams, diving deep into how the company operates.

We finish the interview and you step outside the office and find a lottery ticket that ends up winning £10 million. What would you do?

I would give half to charity as I didn’t own the ticket in the first place. The other half, I would invest in the UK’s Northern property market.

Other than London, where would you like to live/work and why?

I would love to move to Madrid. I spent a large majority of my 3rd year at University in Madrid, and I loved everything it had to offer, especially the food.

Rapid Fire:

- If you could only eat one thing for a month straight, what would it be? Spaghetti Bolognese

- If you could have one superpower, what would it be? Ability to fly

- If you could have dinner with one person, dead or alive, who would it be? Ant Middleton

- Favourite sport? Rugby

- Morning or evening person? Morning

Why the people side of M&A should not be overlooked

Why the people side of M&A should not be overlooked

Twenty years ago there was a great deal of talk about the new economy and how it would change everything we do, how we think about business and creating wealth and how we could participate in this new world order. All this was driven by unimaginable technology innovations that fuelled a frenzy of cash being thrown at little more than half-page ideas.

Fear of missing out was the fuel behind this frenzy.

What became of this collective vision?

Well, it didn’t quite happen as we had all hoped. It did however kick off a tsunami of change that resulted in the business world we live in today.

So what changed in the world of Mergers and Acquisitions?

The motivation behind this type of corporate action has remained the same; it might be the economics arising from adding new market segments or territories or perhaps looking for an attractive exit or succession strategy.

I do think the emphasis of the essentials of sound M&A shifted from the excesses of LBO’s in the 1980’s to more holistic views of wealth creation.

While not all businesses are suitable for growth through acquisition, many are. Companies seeking alternatives to organic growth such as exploring opportunities for a joint venture or an acquisition (or to be acquired), it is most often the economics or vertical or horizontal integration that offers a compelling reason to move ahead.

But are there lessons we can learn from the past and apply now? For example look at the pharma industry over the past few decades. Acquisition by large companies was largely driven by the attraction of acquiring the innovation that comes from small, lean and nimble companies that were able to be creative and cheap in their endeavours. The tech world today is similar and is very much in focus now. Where the pharma’s were acquiring a novel molecule and perhaps a small team their focus was very much on relatively inexpensive R&D that someone else incubated. So too in todays tech world.

Beyond tech and very small companies, some industries are notoriously poor at merging even though their product offerings are pretty much homogenous. This is generally reflected in the due diligence and negotiation processes (on both sides) and highlights the importance of going beyond the numbers to the firm’s culture, ethics and values. It is these ‘soft’ elements of the company that can make or break what might seem like a wonderful opportunity on paper.

The negotiation process, allows both sides the opportunity to get to know one another while all the time thinking, ‘are we a good fit; can we work with these people?’ This people side of M&A is really important and can bring a great deal unstuck if not taken seriously or is ill advised.

Mature companies place a lot of stock in their recruitment process, most particularly at senior and board levels. Post acquisition, the acquirer ends up with a significant number of staff on the books that they didn’t have any input into in the recruiting process so they have to rely on their pre-completion conversations to form a view. It is not an afterthought. There are many reasons a merger/takeover/joint venture may eventually fail and mitigating those reasons makes sense. People, culture, different values and ethics can make what looked like a brilliant economic proposition fall on its face.

So what to do?

Get Advice!

To attempt to complete such a complex and delicate transaction without external independent advisors on your side is reckless. There are too many moving parts, which is why the people side of M&A is so important.

Advisors will not only guide you though the funding, tax, accounting , conditions precedent and subsequent and so on, they will also advise you on the people side. Through their network of executive and team coaches and mentors the people side is far more likely to be dealt with optimally.

Boutique firms have built their reputation on delivering; they can deliver because their staff have have built up a network of relationships and knowledge over the years they can draw on. While they are batting for you they are also independent and it’s that independence that is so valuable. Of course, at the end of the day it’s very much up to you, the buyer or the seller, who will make the final call but the resulting business will only prosper if the people, the board, the teams all want to make it happen.

So, the three P’s? People, People and People.

*Paul O’Donnell is a Bluebox Ambassador, Entrepreneur, Mentor, Author and Poet. His recent book ‘Humble Crumbles: Savouring the crumbs of wisdom from the rise and fall of Humble Pie’ is available on Amazon. Paul can be contacted on email at paul@lisdoonvarna.co.uk

Case Study: FitBiz360

FitBiz360 'Pull Their Story Together'

Background

Fitbiz360, a creation of Transformance Business Solutions Limited, is a

comprehensive, self-service, digital consulting improvement platform that

connects small business founders and teams with expertise, tools and

resources that will enable them to significantly improve financial performance. CEO & Founder, Michael Walters, had met with Bluebox Corporate Finance a few years earlier and was impressed by the advice offered then – which was completely free. This remained with Michael and when he heard of Velocity being a far more accessible entry point, it was a no brainer.

The Challenge

They had developed great software that had a lot of market potential but they needed a clear plan to move forward as they were unsure on how to get FitBiz360 to market properly. The team also needed to align their views in terms of what their target markets were and the channels they should be using in order to reach their

audience.

Why FitBiz360 Chose Velocity's 'Pull My Story Together'

Velocity was chosen as FitBiz360 needed to build their proposition in a way that would drive value and make the business more investable. After looking through the various products on offer on the Velocity site, they felt it was obvious they needed to go through the 'Pull My Story Together' exercise as a first step. They also felt that the Velocity team put a lot of time into being patient with them and gently selling the process.

Our Approach

- Our corporate finance team had 3x ‘1-hour workshops’ with the FitBiz360 leadership team to truly get

under the skin of their business. - We produced a 'Velocity Deck’ on the business, presenting the opportunity in the best possible way

to investors - We presented FitBiz360 with a Profit and Loss Forecast Model which was created from the Opportunity Map that we built for FitBiz360

- We presented FitBiz360 with an assessment of timing with concrete, commercial and realistic pointers

as to how best raise funds

Results

- This process gave FitBiz360 a clear and consolidated path to present their business in such a way that would

generate more value. - After months of feeling like they were going sideways, they have now started to make progress. They are signing up more users with the plan to start converting them to monthly income.

- The workshops with Velocity were paramount as they allowed the FitBiz360 management team to become aligned on business goals as well as clearly demonstrated what steps needed to be taken to grow the business.

"The most insightful and intelligent team that I have ever had the pleasure of working with. I think the team also went above and beyond by organising a session that was outside the scope of the package." - Michael Walters, CEO & Founder

If you would like to get your business to market or are interested in exploring your options, get in touch with us today - info@blueboxvelocity.com

Case Study: Lime Global

Lime Global Discover the 'Art of the Possible'

Background

Incorporated in 2016, Lime Global's mission is to be a force for social good - by making private medical healthcare affordable and accessible to people underserved by traditional insurance companies. As featured in The Times, The Sun and The Telegraph, they are changing the way traditional insurance companies work.

The Opportunity

Lime was delicately balanced when they were introduced to the Velocity team. Lime did not have an infinite bank of resources, much like other companies, so deciding which opportunities to grab first was of utmost importance. Lime needed corporate finance expertise to validate and assist in determining the best pathway with the least risks.

Lime is considered a leader in their market so they wanted to implement clear objectives in order to stay ahead of the curb with their unique offering. Therefore, making sure their next steps were the right steps was crucial.

Why Lime Global chose The 'Art of the Possible'

Velocity was selected to bring the Corporate Finance expertise and objectivity to the decision making process providing an independent review and unbiased number of potential options on the path forward.

Our Approach

- Our corporate finance team had 3x ‘1-hour workshops’ with Lime's leadership

team to truly get under the skin of their business. - We gave Lime access to our proprietary Corporate Finance software, Diagnostix.

- We presented Lime with a fully detailed and frank assessment of potential

‘options’ for their business.

Results

- This process validated Lime's trajectory and solidified their initial thoughts by providing a clear understanding of what needs attention in the short term for Lime to reach its goals and the wins they can achieve through this.

- Lime has plans to do a large fundraise towards the end year. This exercise will contribute to that fundraise in that it has solidified the steps they need to take now in order to be more investable when the time to raise comes.

- Shaun was extremely pleased with the report and felt he could trust it - stressing the value of trust and an unbiased professional opinion.

“The depth of experience and the no nonsense report gave me comfort of our current pathway and the steps we need to follow to realise Lime's full potential as a business and as its stakeholders. The team is very experienced, for me, much of the feedback validated our thoughts and crystallised some of the short term priorities we need to focus on.” - Shaun Williams, CEO & Founder

If you would like to see the same results for your business or are interested in exploring your options, get in touch with us today - info@blueboxvelocity.com

Entrepreneur Interview: Ken Geddes of CarsVansandBikes

Entrepreneur Interview: Ken Geddes of CarsVansandBikes

We had the pleasure of getting to know Ken Geddes, CEO and Founder of CarsVansandBikes.com, an online marketplace for vehicles. CarsVansandBikes.com recognises a consumer need for a convenient way of buying a used or new vehicle by showcasing the best new and used cars, vans and bikes deals on its user-friendly platform. The site also hugely benefits the dealers who work with CarsVansandBikes.com by allowing them to make the most out of their advertising spends and to modernise their selling practices in an ever-changing market. Ken founded CarsVansandBikes.com after setting up a very successful energy company and selling it to GoCo Group, which owns one of the largest comparison websites in the UK.

We chat to the entrepreneur about how the business started, what makes this platform unique in the market, and his future hopes for CarsVansandBikes.com. Ken also shares some pointers for entrepreneurs considering starting their own businesses.

1. What was your background before setting up the company?

Before setting up CarsVansandBikes.com, I was responsible for founding and running Energylinx, the company that has transformed how we buy energy for our homes and businesses today. GoCo Group (the owners of GoCompare.com) approached us and subsequently bought the business for an eight-figure sum in 2018. Having stayed with GoCompare.com for a couple of years, Tom O’Neill (CFO) and several key members from the founding tech team at Energylinx also joined CarsVansandBikes.com ready to fully disrupt this market.

2. How did the idea of your business come about?

We had spotted what was happening in the automotive advertising space: that the motor dealer was being treated as the underdog – similar to how customers had been treated by energy companies. Motor dealers were/are in no way receiving value for their advertising spend and, worse, have to contend with outdated platforms and business models from the pre-Uber/pre-Costa/pre-Google era where everything being offered was a chargeable extra. The only parties really benefitting from the relationship are the incumbent advertising platforms generating the best part of a £0.3billion of profiteering per annum. This one-sided approach created two of the main drivers behind the launch of CarsVansandBikes.com: 1. To become the dealer champion with an ambition of saving them over £1 billion over three years, and 2. To radically modernise the underlying tech allowing dealers to leverage best practices in online selling.

3. What was most challenging about starting your own business?

With Energylinx, we had a vision of putting the power back in the consumers’ control, resulting in a lot of long-term strategic planning to break what had become over decades the only way to buy energy. This meant changing attitudes and in effect creating a market. Now with CarsVansandBikes.com, we have entered an active market controlled by a handful of players who have been treating dealers as their cash cow with no incentive to embrace best-in-class tech or selling practices.

4. What is unique about your business in the market?

Our entire team is fully committed to making a positive difference to the motor dealers we work with. Very rarely does a day go by without a new idea surfacing for our forward work plan – the key here is what can help the dealer as our fundamental principle is to build the absolute best solutions for the dealer and to do so in a way that doesn’t follow the apparent ‘norm’ where everything is an extra! From a cost viewpoint, we present an enhanced offering from existing incumbents at circa 85% less cost to motor dealers and for the private customer completely free of charge forever.

5. How has the Coronavirus pandemic affected the business, and what contingency plans were put in place to ensure survival?

Whilst the Coronavirus has had a horrific impact on businesses and individuals across the globe, it has had no negative impact on CarsVansandBikes.com. It has destabilized our competitors who have had to learn remote working/remote buying techniques whilst we entered the market with nearly two decades of experience with hybrid/remote working and the remote ‘customer’ as the norm. If anything, the pandemic has been very positive in business terms for CarsVansandBikes both in terms of working practices but also of solutions we can provide dealerships.

6. What 2 personality traits do you believe make a good business owner and leader?

The number one trait is of course being a good listener. You’ve got to be able to listen to what your customers actually need and want. There is no benefit to offering features or even a business that is out of tune with the actual market. Everything we are doing, including the timing, wholly reflects the wants and needs of the market. On this point, we have been frankly astounded by the positive embracing of what we are doing – never a day goes by in which our sales team doesn’t hear feedback like “we are so glad you are here”. The second most important trait is a thirst for knowledge: surround yourself with people cleverer than yourself who challenge everything they do daily to ultimately create the absolute best service/product.

7. If you had the chance to start your business over again, would you do anything differently?

The importance of collaborating more was the main lesson we took forward from Energylinx to CarsVansandBikes.com.

8. What advice would you give to a young entrepreneur starting up their own business?

Remember to listen first then strategically plan and listen again. And, make sure you and your team have lots of fun on your journey.

9. Where do you see the business going in the future?

CarsVansandBikes is built on a country and market agnostic tech stack which provides a solid foundation to assist dealers/sellers across the globe in our core automotive market. We have fully scoped international and product expansion plans all funded from our balance sheet.

10. How can firms and individuals, who come across your business, support the business?

It’s simple: if you like what we do, tell everyone you know to have a look at CarsVansandBikes.com.

11. Any final words for our Bluebox community?

If you are an entrepreneur, follow your dreams but always listen.

Rapid Fire:

- If you could have one superpower what would it be? I would prefer to build an Iron Man suit at Georgia Tech (https://www.youtube.com/watch?v=98nNpzE6gIs)

- Name 1 person, past or present you would like to have dinner with Warren Buffet

- Three things to take onto a desert island? Just my Iron Man suit!

- Sunrises or sunsets? Sunrises

Contact: Ken Geddes, CEO & Founder

Email: Ken.Geddes@Carsvansandbikes.com Number: 07956 441983

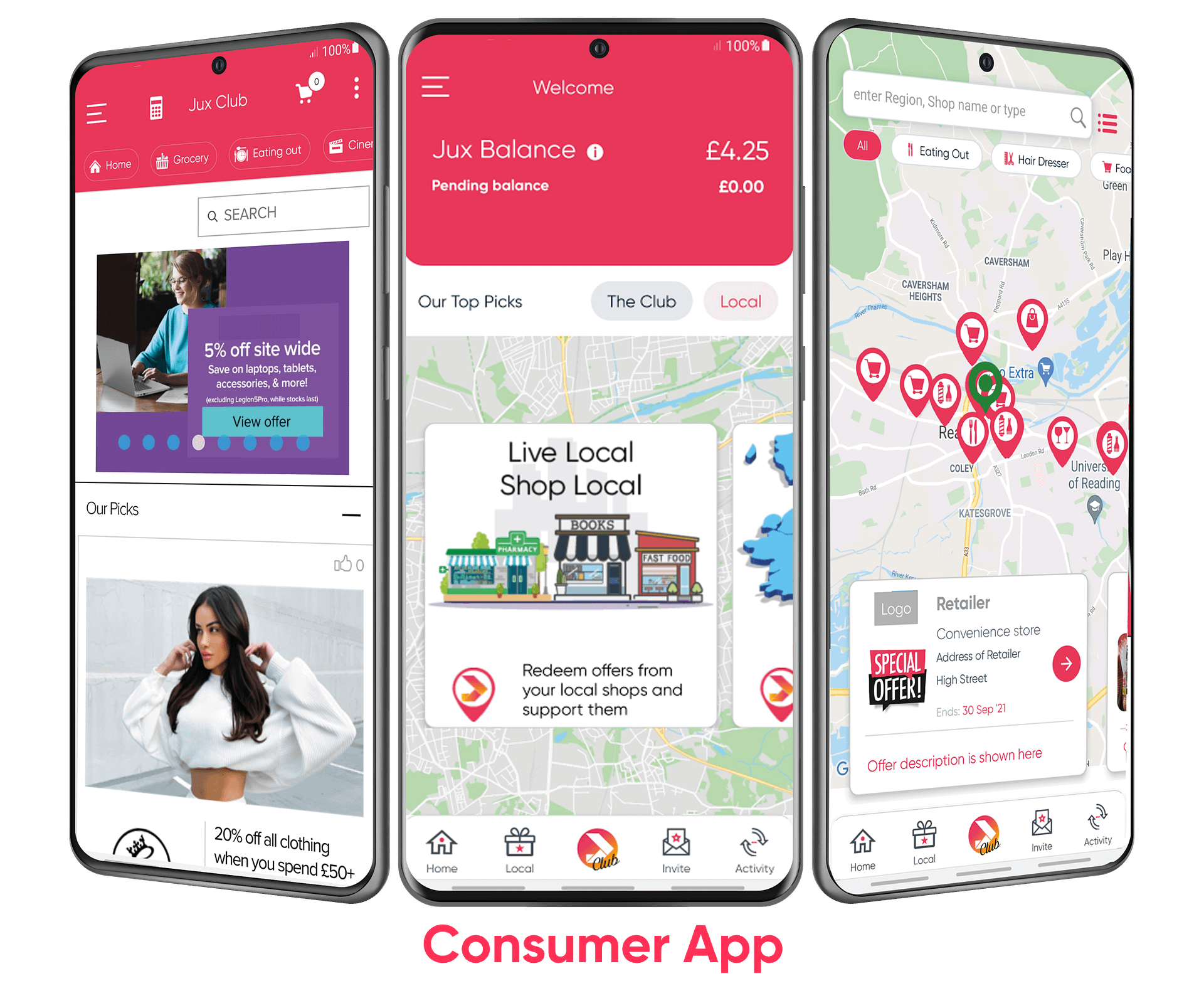

Entrepreneur Interview: Alex Dimitrakoudis of Jux

Entrepreneur Interview: Alex Dimitrakoudis of Jux

We chat with Alex Dimitrakoudis, at Jux, a brand designed to unify payments, loyalty and offers across all market segments. We learn about how his business started, what makes it unique in the market, as well as his hopes for the future of the business. Alex also shares some pointers for entrepreneurs thinking about starting their own business.

1. What was your backgrounds prior to setting up the company?

It was 3 of us, Manish, Mark and I, who founded Jux almost 3 years ago. We met when we worked on behalf of the Competitions and Markets Authority (CMA) at the Open Banking Implementation Entity, in the creation of the UK’s Open Banking Standards. We were responsible for defining the business requirements of the standards, meeting both the CMA’s objectives and the end users’ needs. Before that, all of us worked in various financial institutions, payments and technology organisations, with responsibility for payments and cash management products, digital channels, and product strategy and management. Apart from deep payments expertise, we all have extensive experience managing products throughout the product life cycle, from concept to successful commercialisation. Our partnership is ideal, since our skills, experiences and personal traits complement each other’s, providing a very solid base for Jux’s success.

2. How did the idea of your business come about?

In our time at the Open Banking Implementation Entity, we worked across the ecosystem helping many different ideas come to life. It was during this time, in conversations with the British Retail Consortium (BRC), that we saw the need to help merchants and consumers alike and how Open Banking payments could bring the two together and provide benefits to both. However, we also realised that to counteract consumer inertia and introduce behavioural change for adopting a new payment method, consumers had to be incentivised. Based on this and given the friction at the point of sale in relation to claiming loyalty rewards, we devised the concept of Jux and the unified payments, loyalty and rewards,

3. What was most challenging about starting your own business?

There are many challenges when starting your own business, such as finding the right partners, the right business idea, the right timing for the market and the most appropriate macro-environmental factors, just to name a few. But one of the most important challenges is self-sustainability. In the early stages of a fintech start-up, every single pound of funding raised needs to be used for product development. This leaves no money for paying salaries to founders and other people involved. So, unless significant personal savings exist, people involved may need to share their time with another job which is not ideal. In our case, we were fortunate enough to have built “bench time” savings, having worked as contractors for a few years, and therefore use these funds for our personal sustainability during the early stages. But this may not be the option for everyone and, definitely, is one of the major challenges that is to be faced by start-up founders.

4. What is unique about your business in the market?

Jux is unique in the marker for a number of reasons. First, Jux is positioned uniquely to be the only app that offers a ‘unified payments model’, combining payments, loyalty and offers in a single consumer proposition. Jux was designed from the start with this concept in mind, as opposed to other products who may try to ‘patch’ other value-add services into their core service. Moreover, Jux is the only app that is designed to unify payments and rewards across all market segments, enabling consumers to seamlessly get the best value and have the same experience regardless of whether they are buying from a small local business or a large national retailer.

Jux is unique because it addresses the consumer inertia when adopting a new payment method, by providing consumer incentives via the unified payments, loyalty and offers and the convenience of removing friction. Jux is also unique because it is the only app offering Open Banking bank account payments at the point of sale without requiring any hardware changes or acquisition by retailers and services companies. Finally, Jux combines its unique market position, with disruptive commercials, offering “volume-based” transaction charges as opposed to “value-based.”

5. How did Jux get its name?

Jux gets its name from the word “juxtapose”, as our company is placing together the 3 inherently different services of payments, loyalty and offers, into the same mobile app proposition, with the intention to create a unique effect to our users.

6. How has the Coronavirus pandemic affected the business, and what contingency plans were put in place to ensure survival?

Like many businesses, the pandemic hit just as we were about to launch, causing massive upheaval and uncertainty. The required lockdowns meant people weren’t going out and most retailers were closed. This carried on through most of 2021, so we were unable to launch effectively, as a number of our signed up local merchants ceased trading during this period. More specifically, our original launch plan was for Q3 2020, but the pandemic meant we had to delay our launch, which then impacted our development and investment plans. We were fortunate that through our initial early-stage friends and family investment, we had sufficient funds to cover running the business during the pandemic, but we delayed all the marketing activity we had scheduled until our revised launch in November 2021.

7. What 2 personality traits do you believe make a good business owner and leader?

I can think of more than 2 traits that are very important for a good business leader but at the core, I think the 2 key ones are:

- Business acumen and everything it entails, including not only spotting business opportunities, but also thinking how to generate business & financial value for everyone involved; your fellow directors, your employees, your shareholders & investors, your business partners & suppliers and of course, your business customers and consumers. You need a holistic view of all the above, keeping the right balance at all times.

- Ability to execute plans and deliver results. This gives credibility and reliability on meeting commitments and make investors trust you. It also motivates people and encourages a culture of “target achievement”, irrespective of difficulties that may arise, giving confidence and determination to keep going forward.

8. If you had the chance to start your business over again, would you do anything differently?

I would say to choose a time when there is not a global pandemic, but obviously predicting the occurrence of force majeure events is impossible. Realistically speaking, it would be to vet better the people who are willing to participate in the project of a start-up. Many people tend to be very enthusiastic with a new concept without realising the difficulty of the first years in a start-up company. This results to valuable time and money lost when enthusiasm wears off, reality strikes, and the long-term commitment is no longer available.

9. What advice would you give to a young entrepreneur starting up their own business?

Make sure you understand your market and listen to your customers around what’s actually important to them. Never expect your plan to stay intact and be flexible to have additional plans available just in case.

10. Where do you see the business going in the future?

The Horizon 1 plan for Jux is to complete the current product roadmap, penetrate the market and establish ourselves as a 'unified payments' app and wallet across the UK, achieving our targets of Serviceable Obtainable Market. Longer term, Jux is looking to expand overseas, as the needs that Jux fulfils are not limited purely to the UK and can be delivered globally. The adoption of Open Banking standards across Europe and other parts of the world, creates a perfect platform for our global expansion, since our model can be easily replicated and launched in other countries that support Open Banking Standards and immediate payments. With the right partners involved, global expansion can be achieved rapidly.

11. How can firms and individuals, who come across your business, support the business?

Support for Jux at this stage is best provided by helping us grow. For individuals, this means downloading the Jux app and using the discounts that our current MVP product makes available via the Club, to save and make the most of their money. Users in areas where local shops have been onboarded to Jux, such as Reading, can also benefit from local offers and support Reading businesses, at the same time as saving money. Moreover, individuals can make referrals of Jux to their friends and family, helping us viralise the adoption of Jux and how you can start to unify payments. For businesses who are reliant on consumers, support for Jux can be given by signing up to become part of the Jux Retailer Community, placing their product offers on Jux and using it to increase footfall to their shops.

12. Any final words for our Bluebox community?

Thank you for reading this profile of Jux. I hope I have provided a useful insight into our business and who we are. If you are interested in finding out more about how we unify payments and rewards, or share our vision by investing in Jux, I would be delighted to hear from you. Now is the right time.

Rapid Fire:

- If you could have one superpower what would it be? The ability to see what happens in the future.

- Name 1 person, past or present you would like to have dinner with - Steve Jobs, because his passion for constantly challenging the limits of the ultimate customer experience and product quality is an inspiration to every technology entrepreneur.

- Three things to take onto a desert island? Survival kit, a few good friends and return tickets back home.

- Life motto? “Anything is possible if you dare to dream of it”

Contact: Alex Dimitrakoudis, Chairman & COO

Email: alex@1cardsolutions.com Number: 07795958597