Entrepreneur Interview: Alex Dimitrakoudis of Jux

We chat with Alex Dimitrakoudis, at Jux, a brand designed to unify payments, loyalty and offers across all market segments. We learn about how his business started, what makes it unique in the market, as well as his hopes for the future of the business. Alex also shares some pointers for entrepreneurs thinking about starting their own business.

1. What was your backgrounds prior to setting up the company?

It was 3 of us, Manish, Mark and I, who founded Jux almost 3 years ago. We met when we worked on behalf of the Competitions and Markets Authority (CMA) at the Open Banking Implementation Entity, in the creation of the UK’s Open Banking Standards. We were responsible for defining the business requirements of the standards, meeting both the CMA’s objectives and the end users’ needs. Before that, all of us worked in various financial institutions, payments and technology organisations, with responsibility for payments and cash management products, digital channels, and product strategy and management. Apart from deep payments expertise, we all have extensive experience managing products throughout the product life cycle, from concept to successful commercialisation. Our partnership is ideal, since our skills, experiences and personal traits complement each other’s, providing a very solid base for Jux’s success.

2. How did the idea of your business come about?

In our time at the Open Banking Implementation Entity, we worked across the ecosystem helping many different ideas come to life. It was during this time, in conversations with the British Retail Consortium (BRC), that we saw the need to help merchants and consumers alike and how Open Banking payments could bring the two together and provide benefits to both. However, we also realised that to counteract consumer inertia and introduce behavioural change for adopting a new payment method, consumers had to be incentivised. Based on this and given the friction at the point of sale in relation to claiming loyalty rewards, we devised the concept of Jux and the unified payments, loyalty and rewards,

3. What was most challenging about starting your own business?

There are many challenges when starting your own business, such as finding the right partners, the right business idea, the right timing for the market and the most appropriate macro-environmental factors, just to name a few. But one of the most important challenges is self-sustainability. In the early stages of a fintech start-up, every single pound of funding raised needs to be used for product development. This leaves no money for paying salaries to founders and other people involved. So, unless significant personal savings exist, people involved may need to share their time with another job which is not ideal. In our case, we were fortunate enough to have built “bench time” savings, having worked as contractors for a few years, and therefore use these funds for our personal sustainability during the early stages. But this may not be the option for everyone and, definitely, is one of the major challenges that is to be faced by start-up founders.

4. What is unique about your business in the market?

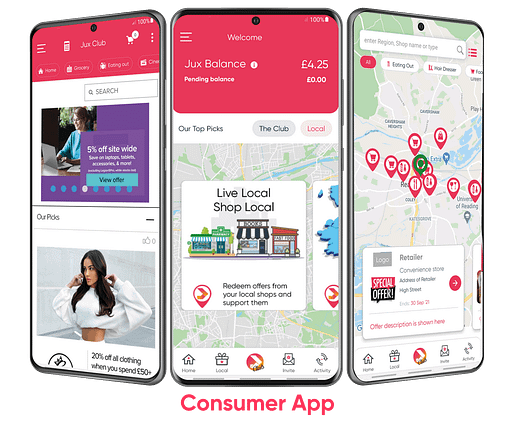

Jux is unique in the marker for a number of reasons. First, Jux is positioned uniquely to be the only app that offers a ‘unified payments model’, combining payments, loyalty and offers in a single consumer proposition. Jux was designed from the start with this concept in mind, as opposed to other products who may try to ‘patch’ other value-add services into their core service. Moreover, Jux is the only app that is designed to unify payments and rewards across all market segments, enabling consumers to seamlessly get the best value and have the same experience regardless of whether they are buying from a small local business or a large national retailer.

Jux is unique because it addresses the consumer inertia when adopting a new payment method, by providing consumer incentives via the unified payments, loyalty and offers and the convenience of removing friction. Jux is also unique because it is the only app offering Open Banking bank account payments at the point of sale without requiring any hardware changes or acquisition by retailers and services companies. Finally, Jux combines its unique market position, with disruptive commercials, offering “volume-based” transaction charges as opposed to “value-based.”

5. How did Jux get its name?

Jux gets its name from the word “juxtapose”, as our company is placing together the 3 inherently different services of payments, loyalty and offers, into the same mobile app proposition, with the intention to create a unique effect to our users.

6. How has the Coronavirus pandemic affected the business, and what contingency plans were put in place to ensure survival?

Like many businesses, the pandemic hit just as we were about to launch, causing massive upheaval and uncertainty. The required lockdowns meant people weren’t going out and most retailers were closed. This carried on through most of 2021, so we were unable to launch effectively, as a number of our signed up local merchants ceased trading during this period. More specifically, our original launch plan was for Q3 2020, but the pandemic meant we had to delay our launch, which then impacted our development and investment plans. We were fortunate that through our initial early-stage friends and family investment, we had sufficient funds to cover running the business during the pandemic, but we delayed all the marketing activity we had scheduled until our revised launch in November 2021.

7. What 2 personality traits do you believe make a good business owner and leader?

I can think of more than 2 traits that are very important for a good business leader but at the core, I think the 2 key ones are:

- Business acumen and everything it entails, including not only spotting business opportunities, but also thinking how to generate business & financial value for everyone involved; your fellow directors, your employees, your shareholders & investors, your business partners & suppliers and of course, your business customers and consumers. You need a holistic view of all the above, keeping the right balance at all times.

- Ability to execute plans and deliver results. This gives credibility and reliability on meeting commitments and make investors trust you. It also motivates people and encourages a culture of “target achievement”, irrespective of difficulties that may arise, giving confidence and determination to keep going forward.

8. If you had the chance to start your business over again, would you do anything differently?

I would say to choose a time when there is not a global pandemic, but obviously predicting the occurrence of force majeure events is impossible. Realistically speaking, it would be to vet better the people who are willing to participate in the project of a start-up. Many people tend to be very enthusiastic with a new concept without realising the difficulty of the first years in a start-up company. This results to valuable time and money lost when enthusiasm wears off, reality strikes, and the long-term commitment is no longer available.

9. What advice would you give to a young entrepreneur starting up their own business?

Make sure you understand your market and listen to your customers around what’s actually important to them. Never expect your plan to stay intact and be flexible to have additional plans available just in case.

10. Where do you see the business going in the future?

The Horizon 1 plan for Jux is to complete the current product roadmap, penetrate the market and establish ourselves as a ‘unified payments’ app and wallet across the UK, achieving our targets of Serviceable Obtainable Market. Longer term, Jux is looking to expand overseas, as the needs that Jux fulfils are not limited purely to the UK and can be delivered globally. The adoption of Open Banking standards across Europe and other parts of the world, creates a perfect platform for our global expansion, since our model can be easily replicated and launched in other countries that support Open Banking Standards and immediate payments. With the right partners involved, global expansion can be achieved rapidly.

11. How can firms and individuals, who come across your business, support the business?

Support for Jux at this stage is best provided by helping us grow. For individuals, this means downloading the Jux app and using the discounts that our current MVP product makes available via the Club, to save and make the most of their money. Users in areas where local shops have been onboarded to Jux, such as Reading, can also benefit from local offers and support Reading businesses, at the same time as saving money. Moreover, individuals can make referrals of Jux to their friends and family, helping us viralise the adoption of Jux and how you can start to unify payments. For businesses who are reliant on consumers, support for Jux can be given by signing up to become part of the Jux Retailer Community, placing their product offers on Jux and using it to increase footfall to their shops.

12. Any final words for our Bluebox community?

Thank you for reading this profile of Jux. I hope I have provided a useful insight into our business and who we are. If you are interested in finding out more about how we unify payments and rewards, or share our vision by investing in Jux, I would be delighted to hear from you. Now is the right time.

Rapid Fire:

- If you could have one superpower what would it be? The ability to see what happens in the future.

- Name 1 person, past or present you would like to have dinner with – Steve Jobs, because his passion for constantly challenging the limits of the ultimate customer experience and product quality is an inspiration to every technology entrepreneur.

- Three things to take onto a desert island? Survival kit, a few good friends and return tickets back home.

- Life motto? “Anything is possible if you dare to dream of it”

Contact: Alex Dimitrakoudis, Chairman & COO

Email: alex@1cardsolutions.com Number: 07795958597